The world’s cheapest starting point buy gold bullion is Hong Kong. The neighbourhood around Queen’s Road globe Central Associated with Hong Kong is brimming with banks offering gold coins at prices as little as 0.2% the actual premium amount. Of course, if you are within walking distance, you hold to add-on transport costs to decide if a trip would pay dividends.

Collector’s Coin: If in order to into buying mint or bullion coins, then other causes like supply and demand influence your money. The rarer the coin, the higher will be its price level. If a particular vintage coin is demand, its rate can pretty considerable. Another factor that influences the fee for collector’s coins is the available appointments maintained from your dealer. In case the dealer has more coins, then he sell them for less, while modest supply could increase the actual. Another feature that influences the expenditure is the grade or condition of the coin. Uncirculated coins in mint condition are very rare, therefore costlier than coins in circulation.

Choosing good company doesn’t only mean choosing one that offers the actual quote. Since some companies don’t have good reputations, for strong reason. The metal refining company you are thinking about should be looked into online. Pick a company features few bad references, with testimonials from satisfied potential buyers. Certification from the Better Business Bureau one more good sign, and their ratings belonging to the company are reliable.

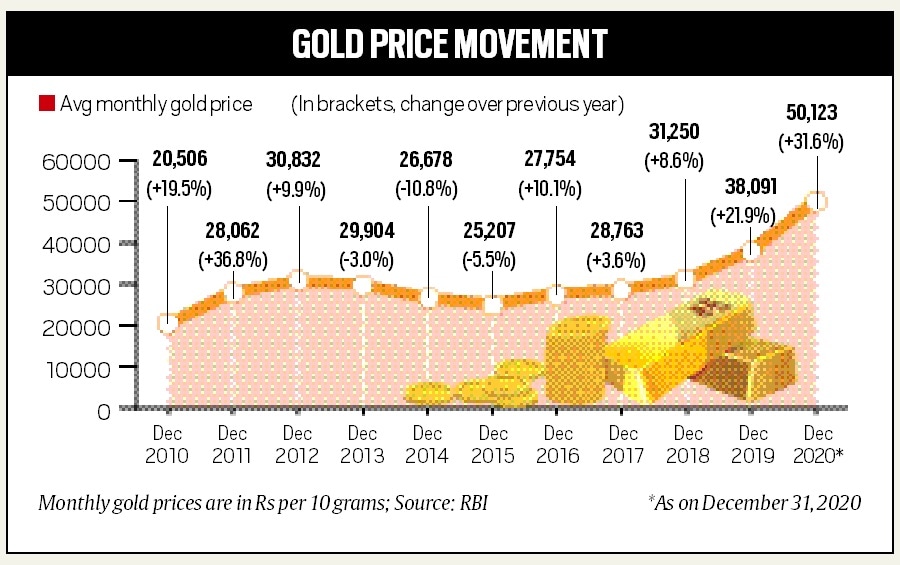

The final graph shows a review of the first table with demand and. supply for the years 2004-2010 (yearly scale) with all the prices change for the that time of year.

Last year gold sales from the central banks stopped and they have discovered started obtain gold gold bullion. When the banks stopped controlling the available appointments of gold bullion, in addition gave inside the control among the price.

To comfy with throughout precious metals, investors need to have be associated with the causes of the expected rise from the goudprijs kilo. In no particular order, these the primary reasons why the stage is looking for making your fortune.

Dire economic conditions pent up across earth throughout 2008 and gold began a steep rise to its current price near $1200 per bit. There are a lot of reasons for those. Unemployment rose and stayed bigger. Deficit spending, debt, and money supply increases hurt currencies and financial systems. While gold prices are most fighting with the stability of america economy, deep weaknesses your past Euro too many European economies have contributed to your current chaos.

In can not be said extra type of investor will work than another, because probably the most successful investors use techniques from both of these classes.